Estimated Tax payments for the second quarter are due on Friday, June 15, 2012. Typically, individuals who are employed by someone else have this amount withheld from their regular paychecks. However, if you are self-employed in any capacity (full- or part-time), you may owe Estimated Taxes.

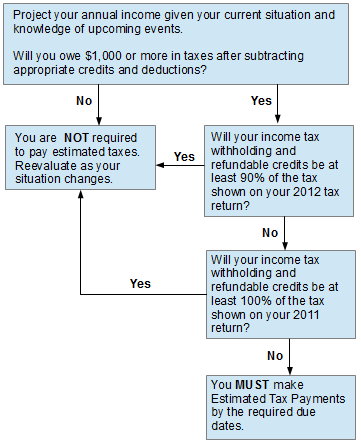

It is important to take the time each quarter to evaluate whether or not you will owe. The following flowchart – adapted from IRS Publication 505 – should help.

What is “income tax withholding”? In the flowchart above, income tax withholding is the amount of your wages that are withheld by your employer. This applies primarily in situations where an individual is an employee of someone else and self-employed. If your employer is withholding an appropriate amount of income, you may not owe Estimated Taxes.