Resources:

Why YOU Should Care:

To encourage people to save for retirement, eligible taxpayers may be able to take a tax credit for retirement contributions.

Eligible Taxpayers

To be eligible to claim this credit, the taxpayer must:

- Be age 18 or older,

- Not be a full-time student, and

- Not be a dependent claimed by another taxpayer

Qualifying Contributions

The credit may be claimed for contributions made to:

- Traditional IRAs

- Roth IRAs

- SIMPLE IRAs

- 401(k) Plans (elective deferrals only, not employer contributions)

- SARSEP

- 403(b) Plans

- 501(c)(18) Plans

- 457(b) Plans

- Thrift Savings Plans

Contributions made by rolling over the money from one plan into another are not eligible as contributions for the credit. Distributions taken in the tax year will reduce the amount of qualifying contributions.

Amount of the Credit

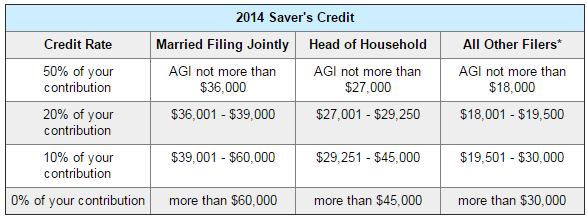

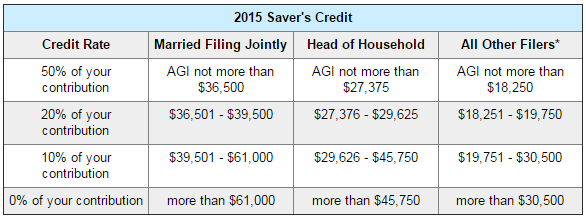

The credit is 10%, 20%, or 50% of contributions up to $2,000 or $4,000 if married filing jointly. The percentage depends on your adjusted gross income as show on these chart from the IRS:

For example, a married couple files jointly in 2014. They earn $37,000 and the wife makes a $2,000 contribution to a traditional IRA. The IRA contribution first reduces adjusted gross income to $35,000. They may also claim a credit of $1,000 (50% of the $2,000 contribution).

Claiming the Credit

You claim the credit by filing a Form 8880 with your timely-filed annual tax return.